Employees Matter: Why Leading Arts Organizations are Embracing Financial Wellness in the Workplace

Posted by Aug 26, 2019

Edward Karam

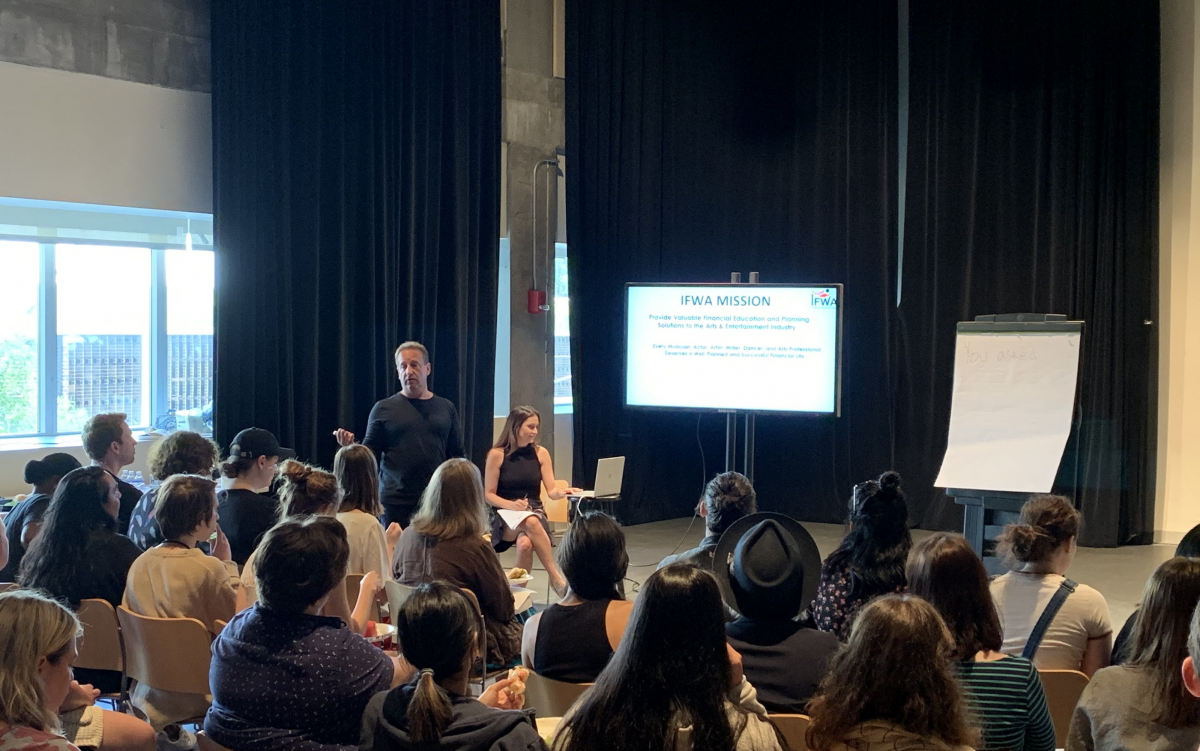

Content presented by the Institute of Financial Wellness for the Arts (IFWA).

If you’re an employee of Veterans United Home Loans, one of the “100 Best Companies to Work For” on Fortune magazine’s 2019 list, you might be invited to a crawfish boil or a party “welcoming the seventh employee named Emily to a department.” Hilton, the hotel company, provides massage chairs for workers on break. And many companies routinely offer stock bonuses for innovative ideas.

But for arts organizations operating on lean budgets, those employee perks are impractical. Young actors, dancers, musicians, and arts staffers have more pressing needs than crawfish boils, and one of the aims of the Institute of Financial Wellness for the Arts (IFWA), launched in 2018 and expanding nationally this year, is to provide advice on handling money to artists of all stripes.

The IFWA has found receptive listeners among arts leaders. “Having a thriving body of dancers is important to us,” says Andrés Holder, the general manager of the Washington Ballet, in the nation’s capital. “Your work force is only as good as it is happy.”

That view is echoed by Meghan Lantzy, the general manager of Signature Theatre in New York City. The staff at Signature (there’s no resident acting company) are “concerned about their futures,” she says. “They’re coming out of school with debt larger than any other generation, and they’re living in New York City. I think it’s a no-brainer that if employees feel financially secure, they’re going to stay somewhere longer.”

Ironically, both Lantzy and Holder heard about the IFWA from listening to the same podcast, on which IFWA founder Darren Sussman was a guest. Sussman, who has worked professionally as a musician, also founded Theatermania, so he is familiar with the needs of artists both as individuals and collectively. He recognized that the financial services industry has neglected the arts sector.

“There’s a misconception that these people are not high earners—that they may not be suitable,” he says. “But oftentimes arts professionals earn as much as, or more than, many other kinds of professionals.” Moreover, he adds, “the traditional financial services industry really doesn’t know who or where they are or how to find them. I know that there are thousands of these organizations across the country.”

According to numbers from the Consumer Financial Protection Bureau released in March, jobs in the arts are growing. Arts and cultural employment nationwide increased 2.5% in 2016, the most recent year for which statistics are available. The U.S. Bureau of Economic Analysis puts revenues in 2016 at $804 billion, or 4.3% of gross domestic product—larger than the construction and education sectors.

Holder also recognizes the IFWA’s benefit to his ballet company. “Arts nonprofits have ever-shrinking or limited budgets,” he says. “We’re trying to serve a broad spectrum of the community with low resources.” Opening the door for his performers and staff to learn about financial wellness “sets a tone and a priority that we want to have a healthy body of artists living and working in this city,” he says.

The IFWA initially provides a complimentary one-hour program to outline the areas crucial to financial security, such as reducing student loan debt, planning for retirement, or saving for a home. Those who are interested in individual coaching can schedule a follow up complimentary consultation as well.

The programs are designed with basic investment information, but, says Sussman, “we curate each experience for the size, for the scope, and for the situation of any given arts institution.” For instance, although the Washington Ballet employs a company of dancers as well as staff, totaling more than 100, with 50 full-timers, Signature has a core staff of 40; actors and designers are hired for individual productions.

The response to the IFWA introductory session at Signature, Lantzy says, was positive. “The conditioning in the arts is that we’re all supposed to be broke, so none of us have been taught to think that we could, with whatever resources we have, still have a healthy financial life and plan to make it better,” she says. “Employees seem comforted just by learning a little bit more. It reset the minds of a lot of people here.” Although Signature already offers a 401(k) savings plan, she says, the staffers “don’t necessarily know how they should invest in that plan.” The IFWA presentation helped orient them toward using it effectively.

While actors might work in character roles into their 70s or 80s, dancers’ careers are far shorter. Many begin as teenagers and forgo education to pursue their careers. For them, says Holder, a transition comes sooner, and planning is essential.

“We have a lot of dancers who are completing their high school degrees while they’re working professionally with us and are moving on to college degrees,” says Holder. “Putting money aside for retirement just gives you a sense of security and motivation.

“There are a lot of options once you establish yourself in a company,” Holder adds. “Some leave dance altogether. Some open their own dance studios. A lot of dancers tend to go into nursing, medicine, physical therapy, or massage therapy. Financial planning starts to complete that picture. That component allows them to have the certainty that, when they step out of the door of the Washington Ballet and say, ‘I want to go do X,’ they are ready to take the leap.”

Learn more about IFWA’s Financial Wellness in the Workplace Program for your organization.